Navigating Market Volatility: Understanding Holiday Impacts in 2025

Related Articles: Navigating Market Volatility: Understanding Holiday Impacts in 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating Market Volatility: Understanding Holiday Impacts in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Market Volatility: Understanding Holiday Impacts in 2025

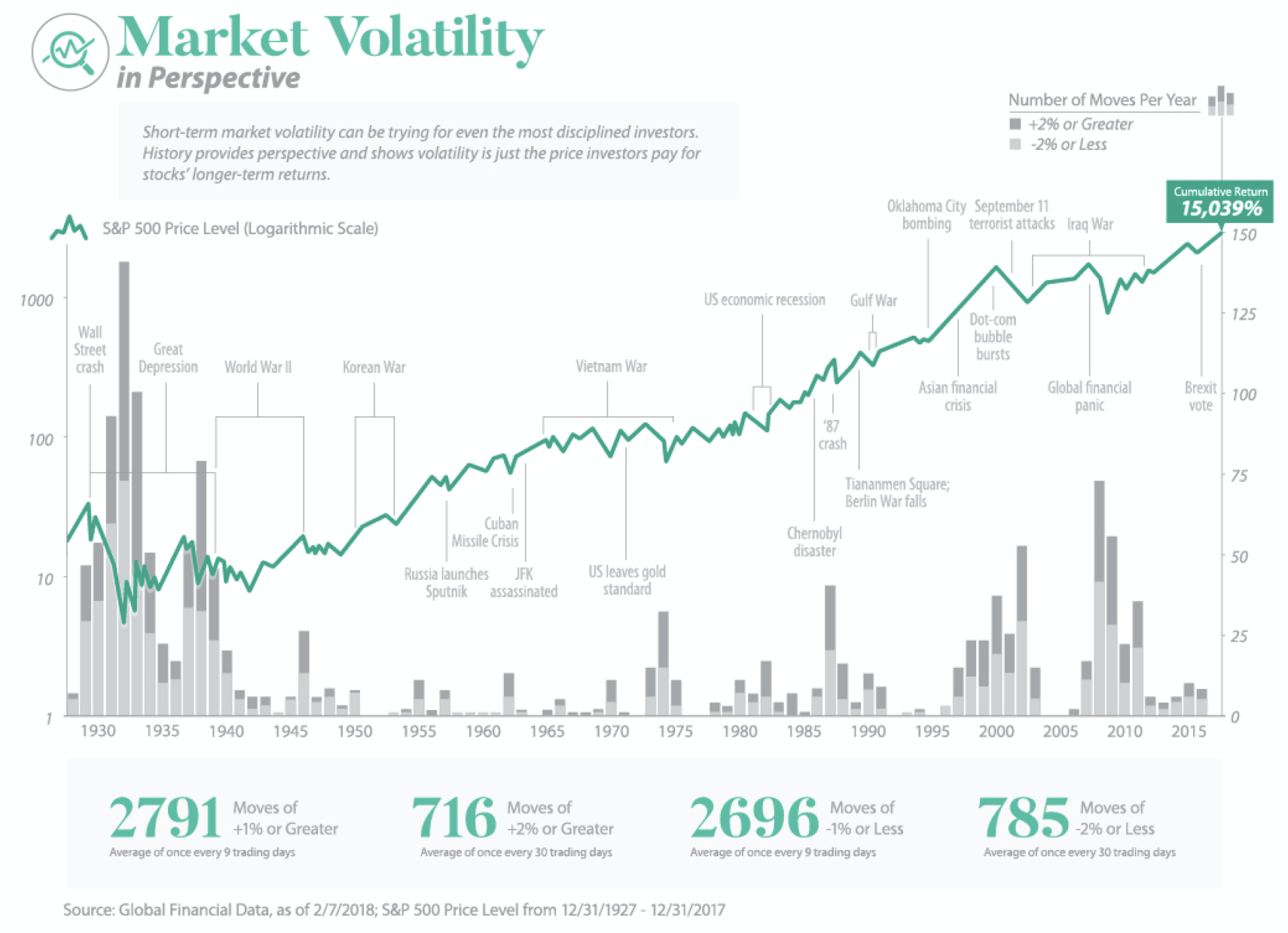

The stock market, a complex ecosystem driven by myriad factors, experiences fluctuations throughout the year. These fluctuations can be amplified during holiday periods, presenting both challenges and opportunities for investors. Understanding the historical patterns and potential drivers of market behavior during holidays is crucial for informed decision-making. This analysis delves into the anticipated market dynamics during holidays in 2025, exploring the historical context, key factors influencing market behavior, and potential strategies for investors.

Historical Context: A Look at Past Holiday Trends

Analyzing historical data provides valuable insights into the typical market behavior during holiday periods. While past performance is not necessarily indicative of future results, studying trends can help investors formulate informed expectations.

- Seasonal Patterns: Historically, the stock market has exhibited a tendency towards positive returns in the months leading up to and following major holidays, particularly during the summer months. This phenomenon, known as the "Santa Claus rally," is often attributed to increased retail investor participation and optimism.

- Volatility Fluctuations: Market volatility tends to decrease during holiday periods, as trading volume typically declines. This reduced activity can lead to wider price swings, as fewer participants are available to absorb buy or sell orders.

- Holiday-Specific Events: Certain holidays, such as Thanksgiving and Christmas, have shown distinct market patterns. Thanksgiving, for instance, has historically been associated with positive returns, while Christmas has exhibited mixed results.

Key Factors Influencing Market Behavior During Holidays

Several factors contribute to the unique market dynamics observed during holiday periods:

- Investor Sentiment: Investor sentiment plays a crucial role in shaping market trends. During holidays, investors may exhibit increased risk aversion, leading to a preference for holding cash or less volatile investments.

- Trading Volume: Reduced trading volume during holidays can amplify price swings. With fewer participants, large buy or sell orders can have a more significant impact on prices.

- Economic Data Releases: While major economic data releases are typically scheduled outside of holiday periods, unexpected announcements or developments can still impact market sentiment.

- Geopolitical Events: Global events, such as political instability or international conflicts, can significantly influence market sentiment, regardless of the holiday season.

Navigating Holiday Market Volatility: Strategies for Investors

Understanding the potential impact of holidays on the stock market is crucial for informed investment decisions. Here are some strategies to consider:

- Diversification: A well-diversified portfolio across different asset classes can help mitigate risk during periods of heightened market volatility.

- Risk Management: Implementing appropriate risk management techniques, such as stop-loss orders, can help limit potential losses.

- Stay Informed: Staying abreast of economic news, geopolitical developments, and market trends is essential, especially during periods of increased volatility.

- Consider Timing: Some investors choose to reduce their exposure to the market during holiday periods, while others may view it as an opportunity to buy stocks at lower prices. The optimal approach depends on individual investment goals and risk tolerance.

FAQs: Addressing Common Concerns

1. Does the stock market always close for holidays?

While major stock exchanges typically close for certain holidays, the specific holidays observed vary depending on the exchange. It’s important to consult the relevant exchange website for the latest information.

2. Is it better to buy or sell stocks during holidays?

There is no definitive answer to this question. Market behavior during holidays can vary significantly, and investment decisions should be based on individual circumstances and market conditions.

3. How can I mitigate the impact of holiday volatility on my portfolio?

Diversifying your portfolio, implementing risk management strategies, and staying informed about market trends can help mitigate the impact of holiday volatility.

4. What are some common mistakes investors make during holidays?

Common mistakes include overtrading, failing to monitor positions, and making emotional decisions based on short-term market fluctuations.

5. Are there any specific holiday periods that are particularly volatile?

Historically, periods around major holidays, such as Thanksgiving and Christmas, have shown greater volatility, as investor sentiment and trading volume can fluctuate significantly.

Tips for Success: A Practical Approach

- Develop a Holiday Trading Plan: Establish clear investment goals and strategies for the holiday season, considering your risk tolerance and market outlook.

- Monitor Market News and Data: Stay informed about economic releases, geopolitical events, and market sentiment during holiday periods.

- Avoid Emotional Decisions: Resist the temptation to make impulsive trades based on short-term market fluctuations.

- Review and Adjust Your Portfolio: Periodically review your portfolio and make necessary adjustments based on market conditions and your investment goals.

- Seek Professional Advice: If you are unsure about how to navigate the holiday market, consider seeking advice from a qualified financial advisor.

Conclusion: Navigating the Holiday Landscape

Navigating the stock market during holiday periods requires a nuanced approach, taking into account the historical context, key influencing factors, and potential strategies. While the market may exhibit increased volatility during these times, investors can capitalize on opportunities by staying informed, managing risk, and making informed decisions. By understanding the unique dynamics of the holiday market, investors can enhance their chances of success and navigate this challenging but potentially rewarding period.

Closure

Thus, we hope this article has provided valuable insights into Navigating Market Volatility: Understanding Holiday Impacts in 2025. We appreciate your attention to our article. See you in our next article!