Understanding HMRC Bank Holidays in 2025: A Comprehensive Guide

Related Articles: Understanding HMRC Bank Holidays in 2025: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Understanding HMRC Bank Holidays in 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding HMRC Bank Holidays in 2025: A Comprehensive Guide

The UK’s tax authority, HMRC (Her Majesty’s Revenue and Customs), operates on a schedule that aligns with national holidays. These holidays impact the availability of HMRC services, affecting taxpayers and businesses alike. Understanding these closures is essential for ensuring timely tax compliance and avoiding potential disruptions.

HMRC Bank Holidays in 2025:

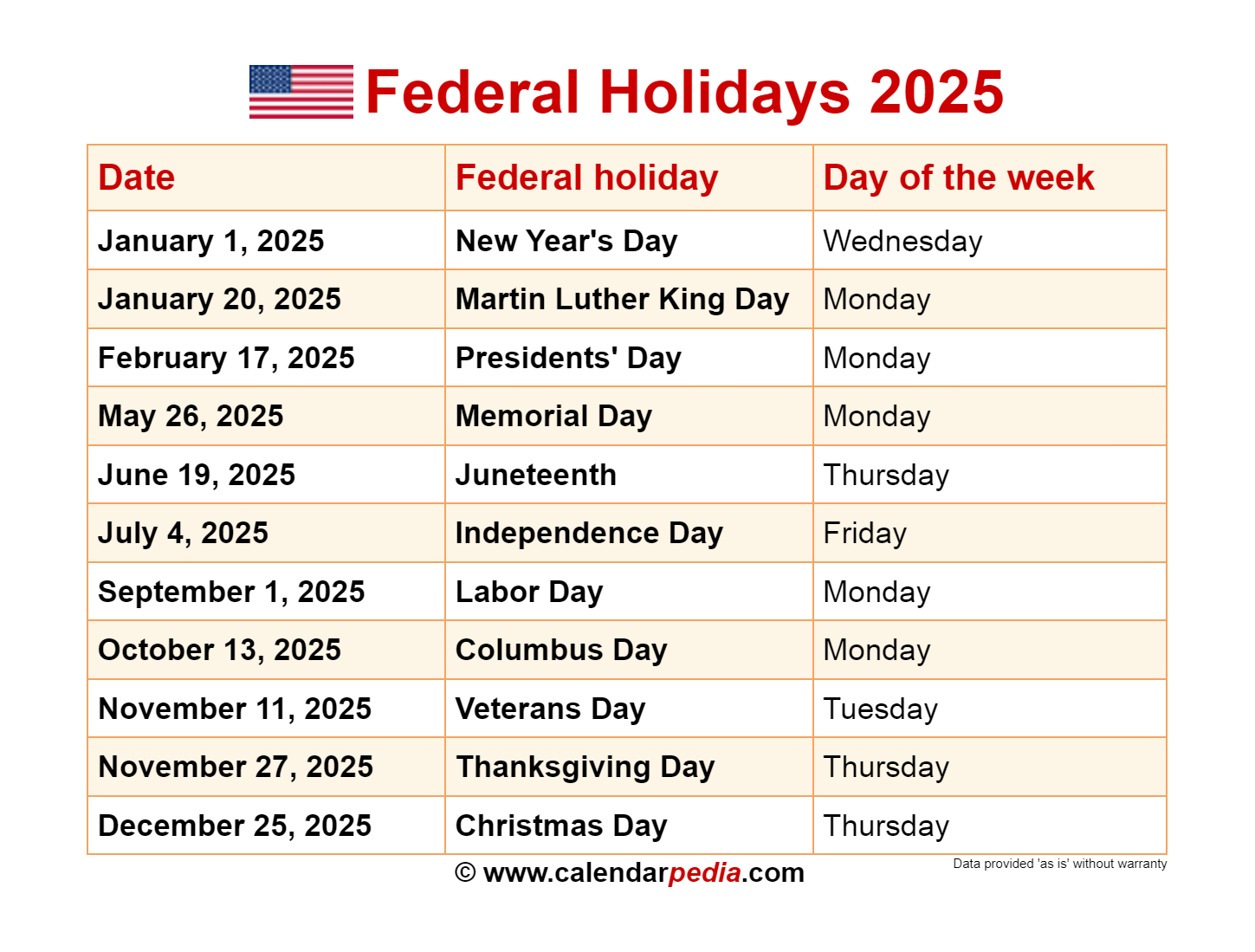

The official list of bank holidays for 2025 in the UK is still subject to confirmation. However, based on the current pattern, it is highly likely that HMRC will adhere to the following dates:

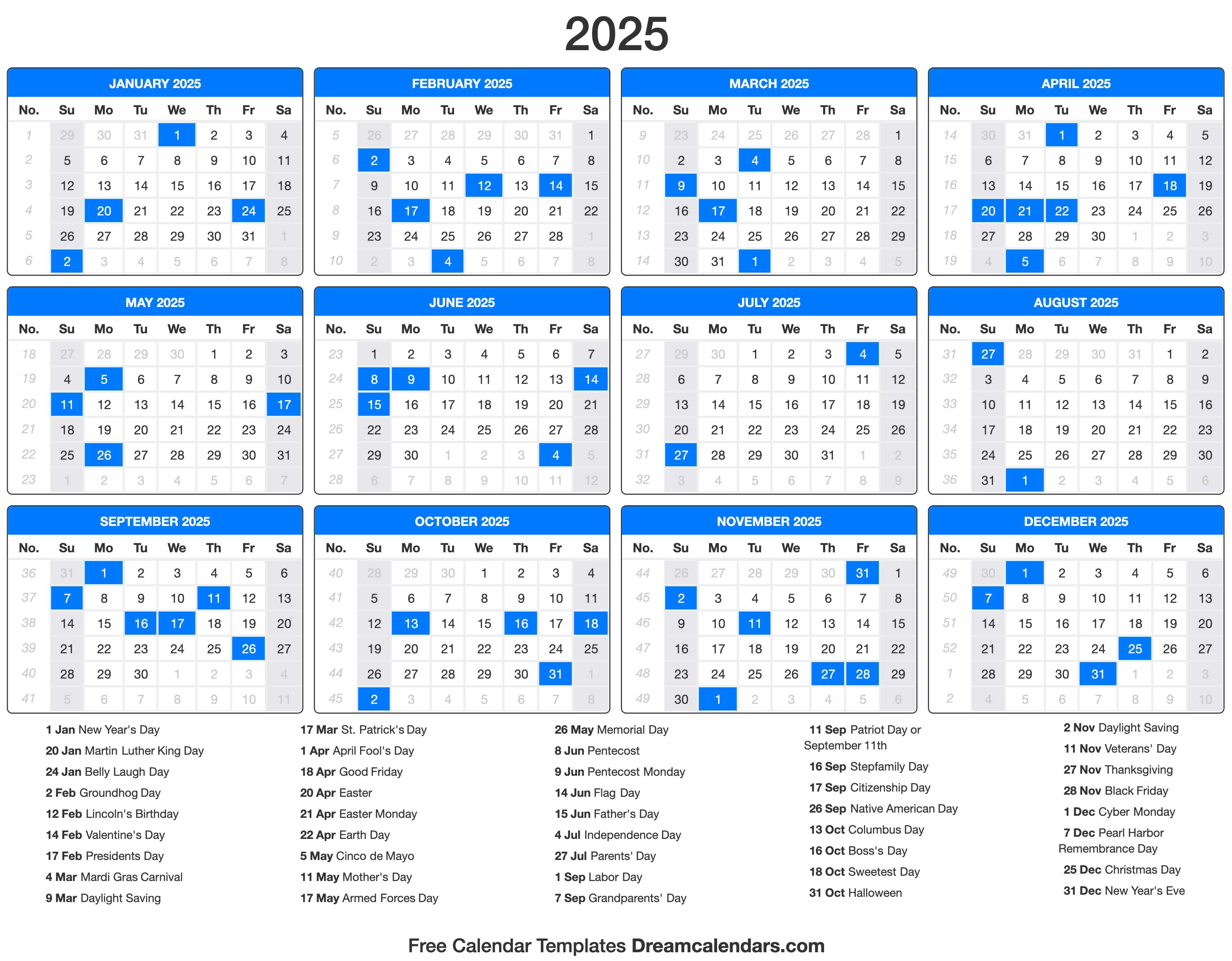

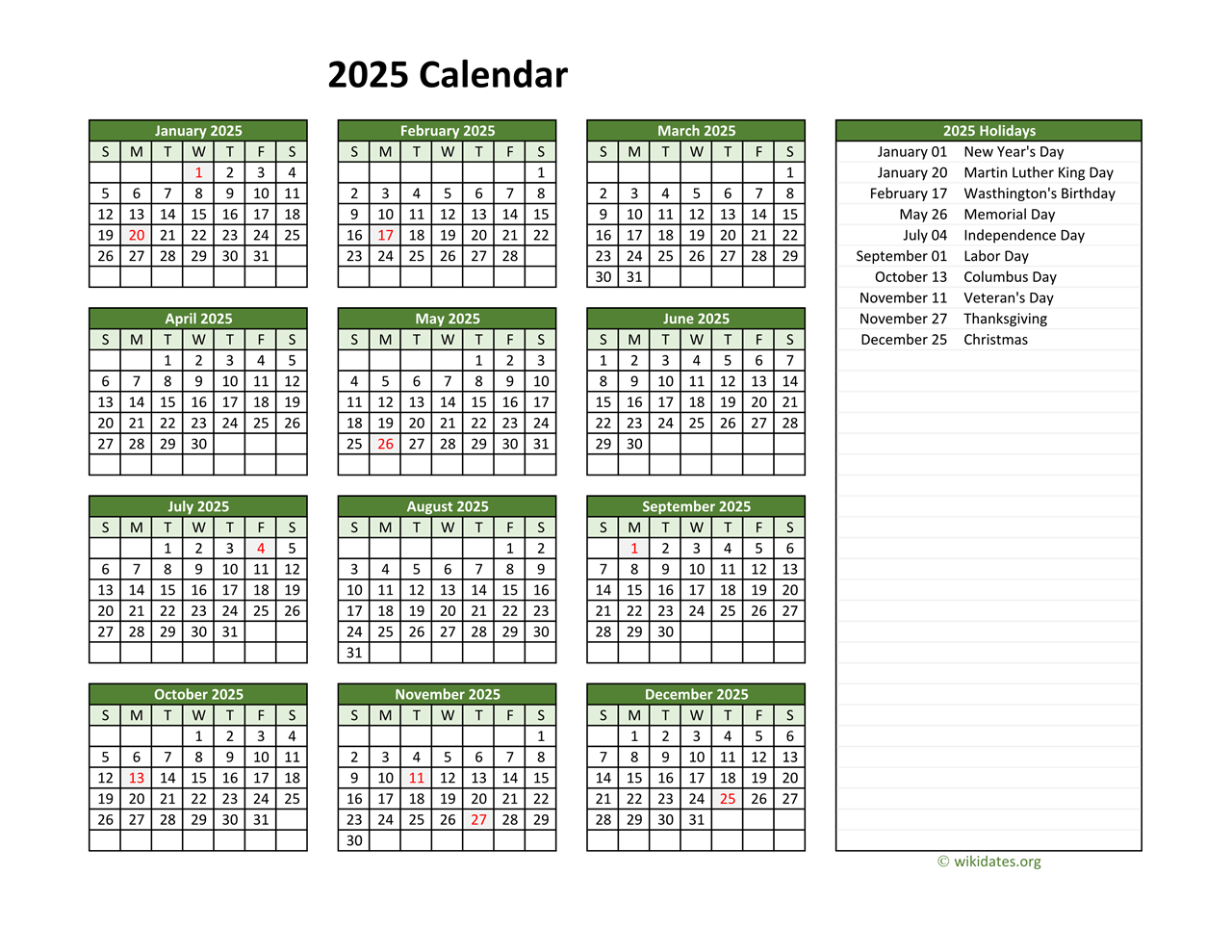

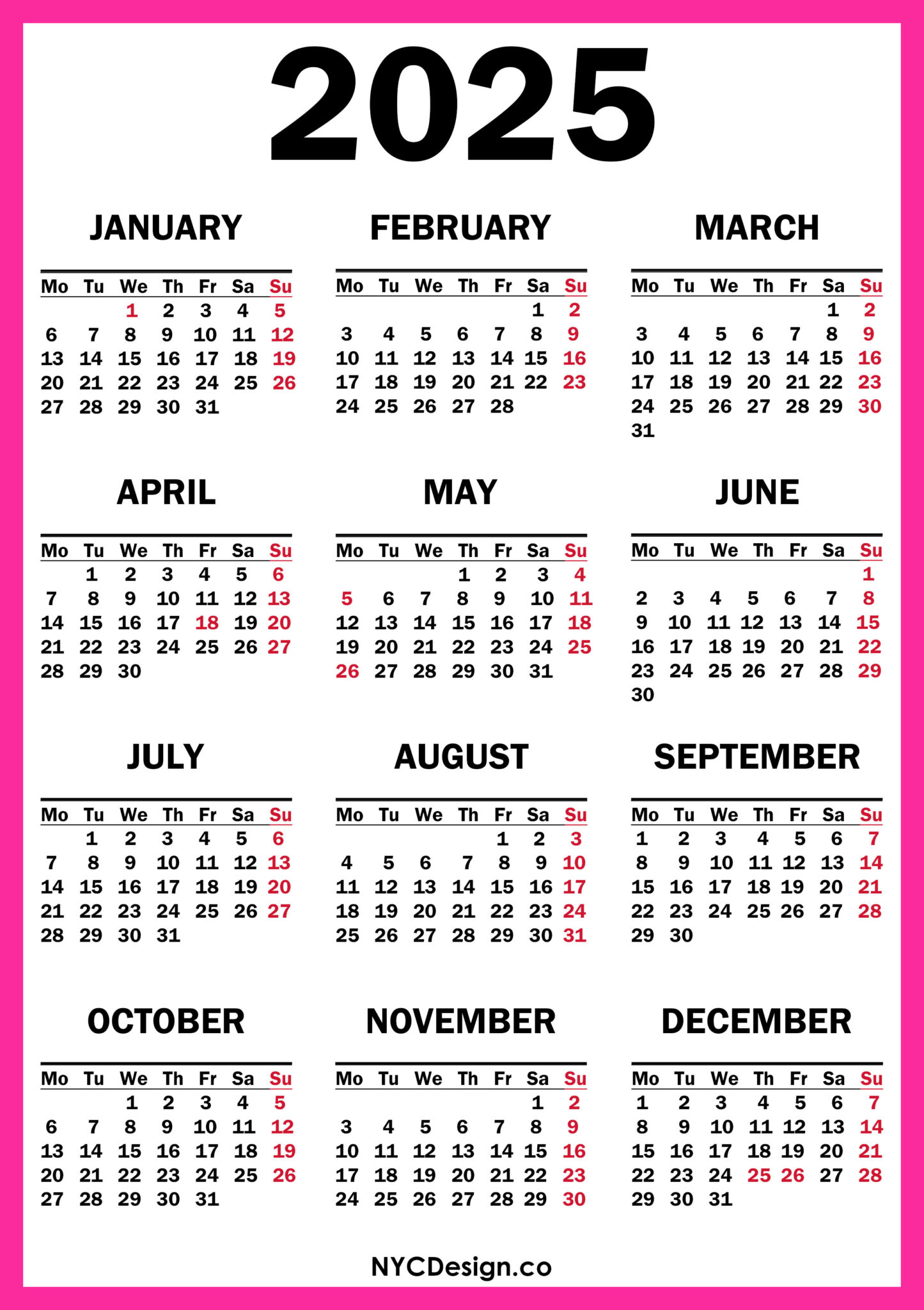

- New Year’s Day: Tuesday, 1 January 2025 (substitute day)

- Good Friday: Friday, 18 April 2025

- Easter Monday: Monday, 21 April 2025

- Early May Bank Holiday: Monday, 5 May 2025

- Spring Bank Holiday: Monday, 26 May 2025

- Summer Bank Holiday: Monday, 25 August 2025

- Christmas Day: Wednesday, 25 December 2025

- Boxing Day: Thursday, 26 December 2025

Impact of HMRC Bank Holidays:

During these holidays, HMRC offices are closed, and most online services are unavailable. This means:

- Tax payments: Due dates falling on a bank holiday are typically shifted to the next working day. However, it is crucial to check the specific deadlines for different tax obligations.

- Telephone lines: HMRC telephone lines are closed on bank holidays.

- Online services: HMRC’s online services, including self-assessment, PAYE, and VAT returns, may be unavailable or experience limited functionality.

- Correspondence: Mail received by HMRC on a bank holiday will be processed on the next working day.

Benefits of Understanding HMRC Bank Holidays:

Recognizing these closures offers significant advantages:

- Avoiding missed deadlines: By understanding the impact of bank holidays on tax deadlines, taxpayers can ensure timely payments and avoid penalties.

- Planning ahead: Businesses and individuals can plan their tax-related activities around these closures, allowing for smoother operations.

- Minimizing disruptions: Knowing when HMRC services are unavailable allows for proactive measures, such as submitting tax returns in advance.

FAQs:

Q: What happens if a tax deadline falls on a bank holiday?

A: Tax deadlines falling on a bank holiday are usually extended to the next working day. However, it is essential to verify specific deadlines for different tax obligations on the HMRC website or through their contact channels.

Q: Can I contact HMRC on a bank holiday?

A: HMRC’s telephone lines are generally closed on bank holidays. However, their online services may offer limited functionality, and taxpayers can access information through the HMRC website.

Q: Are all HMRC services unavailable on bank holidays?

A: Most HMRC services, including online platforms and telephone lines, are unavailable on bank holidays. However, some online services may offer limited functionality, and essential information is accessible through the HMRC website.

Q: What if I need urgent assistance with a tax issue on a bank holiday?

A: For urgent tax matters, taxpayers can attempt to contact HMRC through their website’s online forms or seek advice from a qualified tax advisor.

Tips:

- Check HMRC website: Regularly visit the HMRC website for updates on bank holidays and their impact on services.

- Set reminders: Utilize calendar reminders or other tools to stay informed about upcoming deadlines and bank holidays.

- Plan ahead: Submit tax returns and payments in advance of bank holidays to avoid last-minute rush and potential delays.

- Contact a tax advisor: If you have complex tax issues or require assistance navigating bank holiday closures, consult a qualified tax advisor.

Conclusion:

Understanding HMRC bank holidays and their impact on services is crucial for taxpayers and businesses alike. By recognizing these closures, individuals and organizations can plan ahead, avoid missed deadlines, and ensure smooth tax compliance. Staying informed through official channels and utilizing resources like HMRC’s website and tax advisors is essential for navigating these periods effectively.

Closure

Thus, we hope this article has provided valuable insights into Understanding HMRC Bank Holidays in 2025: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!